[mEDITate-OR:

assume that all you need is a little more sleep....

===========

First, we apologize for taking a few weeks "sabbatical".

-------

Not only were we unable to post economic charts....

we were unable to look for them on the Net.

and save them in GMail.

=======

There were two serious reasons why we could not...

they follow in order below.

=======

How much we we be able to do, now...

we will see, going forward.

=============

RE and economic charts

Finding, and then understanding, relevant and significant Real Estate and economics articles with charts and/or graphs is difficult and time consuming. But, it needs to be done at this time, in this market, and especially in Arizona.

Saturday, March 10, 2012

Passing out is SO-O-O-O embarrassing..., possible even fatal

[mEDITate-OR:

assume that your body is not "talking" to you.

---------

And, if it was not a heart attack, what is really wrong.

-----------

"To (continue) to be, or not to be...

that is the question."

=============

Passing out is SO-O-O-O embarrassing..

-------------

assume that your body is not "talking" to you.

---------

And, if it was not a heart attack, what is really wrong.

-----------

"To (continue) to be, or not to be...

that is the question."

=============

Passing out is SO-O-O-O embarrassing..

-------------

Passing out is bad enough....

but in front of the Desert Storm CR service desk

inside a Walmart..., MOG.

Everything seemed normal when we entered the store to cash our SS checks.

but standing in line, we suddenly felt dizzy.

To get our blood pumping, we started to push up & down to our tiptoes...

that was a mistake, and probably the proximate cause of my passing out.

We did think that blood in our legs would help us stand.

Wrong.

All of "Those Walmart People"...

"looking down" ON me!!

===========

And, then it got a whole lot worse...

[mEDITate-OR:

forget Murphy's Law:

"If anything can go wrong, it will"

and at the most inopportune time.

-----------

forget Murphy's Law:

"If anything can go wrong, it will"

and at the most inopportune time.

-----------

Saturday, February 18, 2012

Bad news on Phoenix area home valuations, but next year may be better

[mEDITate-OR:

assume that what is missing....

will not cost you anything.

----------

----------

For the areas most hard hit by foreclosures, and most underwater, the "all cash buyers" and the banksters feeding them only as fast as they are buying them, have agreed upon a "minimum AZ price" that is now giving those areas a "floor". That floor is not about to change, up or down, now.

For homes that were priced higher than the bulk of the foreclosed homes, there have been few if any buyers - not even for the banksters foreclosures. Those owners are still deeply underwater, and if they want to "buy a buyer" they have to take a huge loss - sometimes having to come up with cash out of their own pocket to buy down their existing mortgages.

Banksters are not currently foreclosing on those homes, for two reasons: first, if they do, they cannot sell them; and two, they will have to "book" that loss, find cash somewhere else to satisfy the FDIC that they are not BK, and then even pay out money to "maintain" - as in protect them from being trashed - them.

Just bcuz you can't hear those "dogs" barking..., does not mean that they do not have their heads down between their paws, whimpering/crying..., each month, all the way to their bank/lender.

The problem is that those bonds contain protection for the lenders that require local and state official to raise taxes if it is necessary to pay in full the current amount due.

Be careful what you ask for, bcuz you just got it.

========

assume that what is missing....

will not cost you anything.

----------

JGBHimself

Feb-20 @ 10:28 PM

It was "ICKy" of you to point out my needing to do more research.

What we did look at, however, was Mike Ord's Cromford Report that pointed out to all of U.S. that at the beginning of 2011 most - over 75% - of properties at foreclosure sales were taken back by the lender. And, as we all know, later listed with the MLS.

However, at the end of 2011 that had almost totally stopped. And, the purchases of foreclosed homes by Third Parties - aka, all cash investors - was greater in number and almost 100% of all sales.

At the same time Mike also pointed out that MLS listings for REOs had dropped from about 8,000 to 2,000 - suggesting to me that the only thing left out there were upper priced foreclosures. Which would also explain why the lenders were not foreclosing on them any more, or taking any more of them back into their REO inventories.

To some that might suggest that, since there are no more REO foreclosures listed on the MLS RE market, that the ONE (1) home you used to support your research, probably could not have been an REO.

To others that might also suggest that if ALL of the least expensive homes being sold now are ONLY sold to all cash investors @ the foreclosure sales, and none from the MLS any more, that over 20% of all home sales are simply NOT reported by the MLS - and all of them are the lowest priced homes.

Now we know how "ICKy" it is to think about, but do you know what happens, statistically, when you remove the bottom 20% of the lowest priced homes from "The Average" sales price?

Well, as every single Realtor, and almost every RE "analyst" not only can, but has been telling you - the average prices are suddenly climbing !!!

So, just as your ONE (1) home sale, and all of Those People are telling U.S.: "Now MUST be the time to buy !!!"

But, don't blame ME if your new home turns out to be worth less than you now going to pay for it.

----------

JGBHimself

Feb-18 @ 2:06 AM

Ms. C, there are two undertows that you did not mention.

For the areas most hard hit by foreclosures, and most underwater, the "all cash buyers" and the banksters feeding them only as fast as they are buying them, have agreed upon a "minimum AZ price" that is now giving those areas a "floor". That floor is not about to change, up or down, now.

For homes that were priced higher than the bulk of the foreclosed homes, there have been few if any buyers - not even for the banksters foreclosures. Those owners are still deeply underwater, and if they want to "buy a buyer" they have to take a huge loss - sometimes having to come up with cash out of their own pocket to buy down their existing mortgages.

Banksters are not currently foreclosing on those homes, for two reasons: first, if they do, they cannot sell them; and two, they will have to "book" that loss, find cash somewhere else to satisfy the FDIC that they are not BK, and then even pay out money to "maintain" - as in protect them from being trashed - them.

Just bcuz you can't hear those "dogs" barking..., does not mean that they do not have their heads down between their paws, whimpering/crying..., each month, all the way to their bank/lender.

-----------

JGBHimself

Feb-18 @ 1:51 AM

Yes, of course. You see they borrowed the money for you to build the jails to house the criminals that you wanted arrested, and some sent off for the rest of their lives to prison.

The problem is that those bonds contain protection for the lenders that require local and state official to raise taxes if it is necessary to pay in full the current amount due.

Be careful what you ask for, bcuz you just got it.

----------

JGBHimself

Feb-18 @ 2:32 AM

Oh, and when AZ decided that they could not charge developers or builders for the infrastructure - roads, water & sewer, fire stations, schools, police stations and local courts, and shopping strip mall intersections - to provide "services" to those subdivisions that did, & those that never got built...

you and your government had to borrow the money to build them, for them.

Sadly, when the subdivisions & malls never got built, or never got filled up; and the foreclosures emptied the ones that did;there is no body left to pay the taxes to pay back the bonds. Except for you.

So, once again, YOUR taxes must be raised to pay off bond obligations that YOU created in order that huge profits could be made by developers and builders - before they went BK, of course - while you paid their bills for them.

The Good News, for you, is that all of it is not due today.

The Bad News, for you, is that they are 20-5 year revenue bonds, issued at then very high interest rates, not at current very low rates.

And, if you cannot or refuse to pay your taxes, they can and will foreclose on you and sell your property - to pay for YOUR real estate growth bills.

Just at we all know that mortgage borrowers are morally obligated to pay off all of their mortgage debts..., YOU are legally obligated to pay off those RE debts that you created for someone else. Have a nice day.

Sadly, when the subdivisions & malls never got built, or never got filled up; and the foreclosures emptied the ones that did;there is no body left to pay the taxes to pay back the bonds. Except for you.

So, once again, YOUR taxes must be raised to pay off bond obligations that YOU created in order that huge profits could be made by developers and builders - before they went BK, of course - while you paid their bills for them.

The Good News, for you, is that all of it is not due today.

The Bad News, for you, is that they are 20-5 year revenue bonds, issued at then very high interest rates, not at current very low rates.

And, if you cannot or refuse to pay your taxes, they can and will foreclose on you and sell your property - to pay for YOUR real estate growth bills.

Just at we all know that mortgage borrowers are morally obligated to pay off all of their mortgage debts..., YOU are legally obligated to pay off those RE debts that you created for someone else. Have a nice day.

----------

| CITY | MEDIAN VALUE 2011 | MEDIAN VALUE 2010 | PERCENT DROP |

| Ahwatukee | $154,700 | $165,600 | -6.6% |

| Avondale | $76,300 | $83,700 | -8.8% |

| Buckeye | $69,300 | $74,800 | -7.4% |

| Carefree | $406,800 | $409,900 | -0.8% |

| Cave Creek | $309,500 | $315,000 | - 1.75% |

| Chandler | $127,700 | $136,600 | -6.5% |

| El Mirage | $53,500 | $56,800 | -5.8% |

| Fountain Hills | $204,600 | $206,000 | -0.7% |

| Gila Bend | $26,800 | $30,100 | - 11% |

| Gilbert | $143,00 | $143,00 | - 5.6% |

| Glendale | $72,100 | $81,000 | -11 % |

| Litchfield Park | $131,300 | $141,300 | - 7.1% |

| Mesa | $91,500 | $100,700 | -9% |

| Paradise Valley | $833,500 | $828,250 | - 0.6% |

| Peoria | $108,700 | $118,700 | -8.4% |

| Phoenix | $69,000 | $78,300 | -12% |

| Scottsdale | $220,500 | $227,000 | -3% |

| Sun City | $69,500 | $77,700 | -10.5% |

| Surprise | $91,100 | $96,600 | -5.7% |

| Tempe | $107,500 | $124,500 | -13.7% |

| Tolleson | $32,700 | $33,000 | -0.9% |

Bad news on Phoenix area home valuations

but next year may be better

===========

Friday, February 17, 2012

Say Hello to the GOP's New Favorite Statistic: Workforce Participation

[mEDITate-OR:

wonder where "stupidity" really lies....

-------------

========

========

Say Hello to the GOP's New Favorite Statistic: Workforce Participation

http://www.theatlantic.com/business/archive/2012/02/say-hello-to-the-gops-new-favorite-statistic-workforce-participation/253265/

===============

wonder where "stupidity" really lies....

-------------

JGBellHimself

Said you, our "crossing over", Jordan:

"The workforce participation rate is a lot more straightforward.

If millions of unemployed Americans throw in the towel and stop looking for jobs, the rate goes down. "

Observed we:

That is simply flat out wrong.

The ONLY thing an unemployed American can DO to change the participation rate is to find and take a new job.

What long-term unemployed Americans now know, that you and the R's apparently do not, is that even when & if they do find a job opportunity, it is no longer open to them. And, since they will never, ever be able to contribute any more into their SS, what the rest of U.S. Americans really need to do is cut their future benefits - so we can cut "some of our" taxes, of course.

-----------------

JGBellHimself

Also said you, correctly this time:

The Participation rate:

"it's risen for Americans over the age of 55. It's even higher for those older than 65"

------------

Observe we:

FIRST, there are two very different undertows that will help explain that:

ONE, everyone 62 & above knows that IF they delay retirement, they will be given a large increase in SS each and every year they delay. So, hearing all the talk of cutting SS benefits, they can offset ALL of those negative impacts simply by keeping the job they have for a few more years. The ROI of the delay is huge.

TWO, everyone below 62 who is both - long-term unemployed with little or no hope of ever finding another job, let alone one paying high wages; and who have NO way to delay their SS retirement to obtain the increases in SS others can - also knows that IF their SS is going to be cut, and IF they retire BEFORE they are cut, thereby avoiding the cuts to them, the ROI of taking early SS is huge.

And, that does not even count the free medical benefits of Medicare and Medicaid !!

----------

SECOND, those in the first category do not change the participation rate - they were employed, and they still are employed. Those in the second category do NOT change the participation rate either - they were not employed, they are not going to GET re-employed, AND taking early SS does not change the participate rate either.

-------

THIRD, given the huge hit that older working Americans have taken in the value of their homes and in their personal investments, that they now realize not only has not changed, and probably may never; are, shall we say, "tempted" to hang on to their jobs and income for a few more years to try to minimize the damages to them.

Younger Americans, bcuz they do not loose as much to do it, are going back to school, to re-invent themselves and their skills, in order to seek out better, higher paying jobs - to try to avoid what is happening to their parents. The ROI of their investing in their future is huge.

---------

You do see, do you not, that most Americans are NOT stupid.

Politicians are, by definition; Sunday "talking heads" are, by all the available evidence; R's are, probably by "nature" and defective genes; D's are, probably by "nurture" and Alzheimers - none of them seem to remember what Obama said he would change, or recognize that he lied.

--------

Fourth, since there never has been, are not now and never will be, any lawyers in Heaven; both of the Obamas know that merely lying will not change where they will spend eternity. And, like Flip, they can tell U.S. "...the Devil made me do it !!!"

The Participation rate:

"it's risen for Americans over the age of 55. It's even higher for those older than 65"

------------

Observe we:

FIRST, there are two very different undertows that will help explain that:

ONE, everyone 62 & above knows that IF they delay retirement, they will be given a large increase in SS each and every year they delay. So, hearing all the talk of cutting SS benefits, they can offset ALL of those negative impacts simply by keeping the job they have for a few more years. The ROI of the delay is huge.

TWO, everyone below 62 who is both - long-term unemployed with little or no hope of ever finding another job, let alone one paying high wages; and who have NO way to delay their SS retirement to obtain the increases in SS others can - also knows that IF their SS is going to be cut, and IF they retire BEFORE they are cut, thereby avoiding the cuts to them, the ROI of taking early SS is huge.

And, that does not even count the free medical benefits of Medicare and Medicaid !!

----------

SECOND, those in the first category do not change the participation rate - they were employed, and they still are employed. Those in the second category do NOT change the participation rate either - they were not employed, they are not going to GET re-employed, AND taking early SS does not change the participate rate either.

-------

THIRD, given the huge hit that older working Americans have taken in the value of their homes and in their personal investments, that they now realize not only has not changed, and probably may never; are, shall we say, "tempted" to hang on to their jobs and income for a few more years to try to minimize the damages to them.

Younger Americans, bcuz they do not loose as much to do it, are going back to school, to re-invent themselves and their skills, in order to seek out better, higher paying jobs - to try to avoid what is happening to their parents. The ROI of their investing in their future is huge.

---------

You do see, do you not, that most Americans are NOT stupid.

Politicians are, by definition; Sunday "talking heads" are, by all the available evidence; R's are, probably by "nature" and defective genes; D's are, probably by "nurture" and Alzheimers - none of them seem to remember what Obama said he would change, or recognize that he lied.

--------

Fourth, since there never has been, are not now and never will be, any lawyers in Heaven; both of the Obamas know that merely lying will not change where they will spend eternity. And, like Flip, they can tell U.S. "...the Devil made me do it !!!"

--------------

----------

Say Hello to the GOP's New Favorite Statistic: Workforce Participation

http://www.theatlantic.com/business/archive/2012/02/say-hello-to-the-gops-new-favorite-statistic-workforce-participation/253265/

===============

Thursday, February 16, 2012

MBA Application Survey – Feb 15

[mEDITate-OR:

assume that all the PIIGS are equal

--------

the purchase application volume declined 8.4%

and

the refinance application increased 0.8%

----------

as the next post shows U.S. the mortgage interest rates stayed at their all time lows...!!!

but, purchase apps declined by almost 10%

What's up with this?

-------

----------

==========

MBA Application Survey – Feb 15

http://paper-money.blogspot.com/2012/02/reading-rates-mba-application-survey_15.html

=========

assume that all the PIIGS are equal

--------

the purchase application volume declined 8.4%

and

the refinance application increased 0.8%

----------

as the next post shows U.S. the mortgage interest rates stayed at their all time lows...!!!

but, purchase apps declined by almost 10%

What's up with this?

-------

----------

==========

MBA Application Survey – Feb 15

http://paper-money.blogspot.com/2012/02/reading-rates-mba-application-survey_15.html

=========

FMac+MBA = 30-Year Fixed-rate Mortgage Unchanged From All-time Record Low = at 3.87 pct.

[mEDITate-OR:

wonder if the problem is that RE loans are not being made...

not that they are "affordable"

---------

-------------

============

MBA Reading Rates: Feb 15

http://paper-money.blogspot.com/2012/02/reading-rates-mba-application-survey_15.html

----------

30-year mortgage rate stays at record 3.87%

Low rates have done little to boost the struggling housing market

=========

wonder if the problem is that RE loans are not being made...

not that they are "affordable"

---------

-------------

============

MBA Reading Rates: Feb 15

http://paper-money.blogspot.com/2012/02/reading-rates-mba-application-survey_15.html

----------

30-year mortgage rate stays at record 3.87%

Low rates have done little to boost the struggling housing market

=========

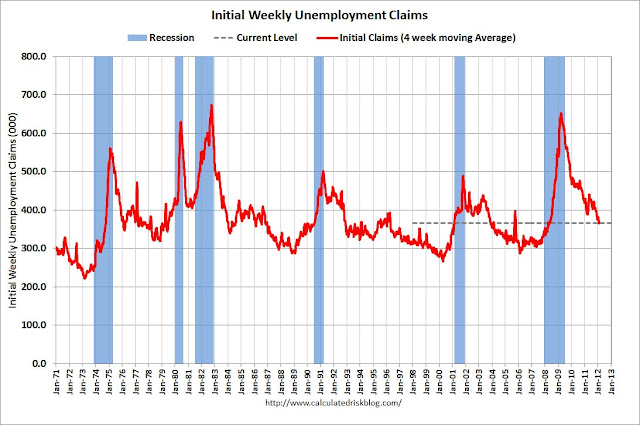

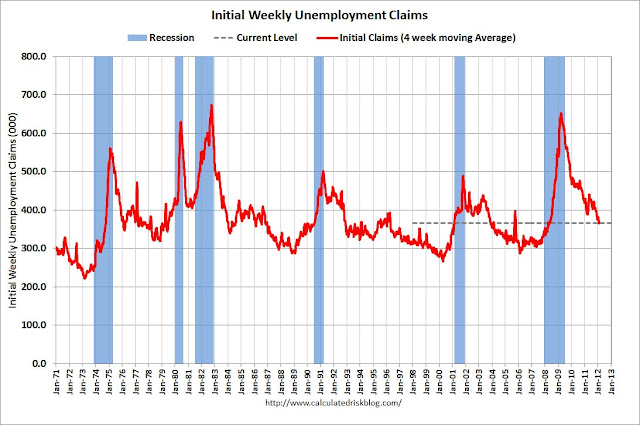

PE+CR = Unemployment: Initial, Continued and Extended Claims Feb 16 = Weekly Initial Unemployment Claims decline to 348,000

[mEDITate-OR

------------

------------

-----------

---------

===========

PE+CR

Unemployment: Initial, Continued and Extended Claims Feb 16

http://paper-money.blogspot.com/2012/02/extended-unemployment-initial-continued_16.html

-----------

Weekly Initial Unemployment Claims decline to 348,000

http://www.calculatedriskblog.

============

------------

------------

-----------

---------

===========

PE+CR

Unemployment: Initial, Continued and Extended Claims Feb 16

http://paper-money.blogspot.com/2012/02/extended-unemployment-initial-continued_16.html

-----------

Weekly Initial Unemployment Claims decline to 348,000

http://www.calculatedriskblog.

============

Friday, February 10, 2012

Greece’s debt rose to 159.1% of GDP in Q3 of 2011 from 138.8% year earlier; Ireland's rose from 88.4% to 104.9%

[mEDITate-OR:

not notice that Ireland is sinking, once again...

now, with absolutely nothing to borrow against.

---------

Next year we will be able to buy Jameson's irish whiskey and Guinness really, really cheap.

----------

------------------

The Eurozone (EA17) includes Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

The EU27 includes Belgium (BE), Bulgaria (BG), the Czech Republic (CZ), Denmark (DK), Germany (DE), Estonia (EE), Ireland (IE), Greece (EL), Spain (ES), France (FR), Italy (IT), Cyprus (CY), Latvia (LV), Lithuania (LT), Luxembourg (LU), Hungary (HU), Malta (MT), the Netherlands (NL), Austria (AT), Poland (PL), Portugal (PT), Romania (RO), Slovenia (SI), Slovakia (SK), Finland (FI), Sweden (SE) and the United Kingdom (UK)

=========

Greece’s debt rose to 159.1% of GDP in Q3 of 2011

from 138.8% year earlier;

Ireland's rose from 88.4% to 104.9%

http://www.finfacts.ie/irishfinancenews/article_1023884.shtml

==========

not notice that Ireland is sinking, once again...

now, with absolutely nothing to borrow against.

---------

Next year we will be able to buy Jameson's irish whiskey and Guinness really, really cheap.

----------

------------------

The Eurozone (EA17) includes Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

The EU27 includes Belgium (BE), Bulgaria (BG), the Czech Republic (CZ), Denmark (DK), Germany (DE), Estonia (EE), Ireland (IE), Greece (EL), Spain (ES), France (FR), Italy (IT), Cyprus (CY), Latvia (LV), Lithuania (LT), Luxembourg (LU), Hungary (HU), Malta (MT), the Netherlands (NL), Austria (AT), Poland (PL), Portugal (PT), Romania (RO), Slovenia (SI), Slovakia (SK), Finland (FI), Sweden (SE) and the United Kingdom (UK)

=========

Greece’s debt rose to 159.1% of GDP in Q3 of 2011

from 138.8% year earlier;

Ireland's rose from 88.4% to 104.9%

http://www.finfacts.ie/irishfinancenews/article_1023884.shtml

==========

US Trade Deficit now equal to the last year in W's term of office

[mEDITate-OR:

assume that the recession must be over...

the trade deficit is now as large as it was when the collapse began.

See, we really ARE back to normal.

---------------

===========

US goods and services trade deficit was $558.0bn in 2011

- up $58bn on 2010

http://www.finfacts.ie/irishfinancenews/article_1023914.shtml

----------------

============

assume that the recession must be over...

the trade deficit is now as large as it was when the collapse began.

See, we really ARE back to normal.

---------------

-------------

-----------

-----------

===========

US goods and services trade deficit was $558.0bn in 2011

- up $58bn on 2010

http://www.finfacts.ie/irishfinancenews/article_1023914.shtml

----------------

============

China's Trade Surplus = up in Dec and for the year and against U.S.

[mEDITate-OR:

not appreciate the "cushion" that China creates for itself

to protect themselves from U.S. and from Europe

-------

Some notice Germany does that, Canada does that, Japan does that, Russia does that and even Australia does that.

More like U.S. are: Greece, Ireland, Spain, Portugal - just a bunch of PIIGS.

----------

============

not appreciate the "cushion" that China creates for itself

to protect themselves from U.S. and from Europe

-------

Some notice Germany does that, Canada does that, Japan does that, Russia does that and even Australia does that.

More like U.S. are: Greece, Ireland, Spain, Portugal - just a bunch of PIIGS.

----------

============

Canada's Trade Surplus doubles

[mEDITate-OR:

not notice that the Loonie is back UP, and so is the Trade Surplus.

-------

==========

not notice that the Loonie is back UP, and so is the Trade Surplus.

-------

==========

German Exports Slump Most Since Jan 09 = exports top trillion euro mark + German Industrial Output Falls Unexpectedly In Dec = Trade Figures Pose Growth Risk

[mEDITate-OR:

not learn that Germany is throwing out their "baby"...

along with Greece's bathwater.

--------

However, there are those who have been to Greece...

who tell U.S. that The Greeks don't take baths.

-------------

Exports down by 4.3% in December. Industrial production down by 2.9% in the same month.

An economy on the skids? It certainly looks that way.

Are we talking about Greece? No. Portugal? Think again.

The economy in question here is Germany,

which has started to post the sort of data that smacks of a double-dip recession in Europe's biggest economy.

---------

![[EUECON]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_v1-SYBrEJ95fDkAoIC4L4SIsMhMFxoqiYsUw7xe0wR_Tqex-M7xNdhtmKTGjS5qRq4IlPih56_d37wsFmlck-cJtrGs5vt67uJrGwyaagxS-WnAfTn6kChJTN620jg3E3OAQXpsbKeqrTyZ0mUgKNpsg=s0-d)

===========

===========

German exports fell in December;

Exports rose 11.4% in 2011 to €1.06trn

http://www.finfacts.ie/

------------

Austerity is turning Germany into a basket case too

http://www.guardian.co.uk/

------------

German Exports Slump Most Since Jan 09

----------

German Industrial Output Falls Unexpectedly In December

-----------

Trade Figures Pose Growth Risk

=============

not learn that Germany is throwing out their "baby"...

along with Greece's bathwater.

--------

However, there are those who have been to Greece...

who tell U.S. that The Greeks don't take baths.

-------------

Exports down by 4.3% in December. Industrial production down by 2.9% in the same month.

An economy on the skids? It certainly looks that way.

Are we talking about Greece? No. Portugal? Think again.

The economy in question here is Germany,

which has started to post the sort of data that smacks of a double-dip recession in Europe's biggest economy.

---------

-------

------------

---------------

German exports fell in December;

Exports rose 11.4% in 2011 to €1.06trn

http://www.finfacts.ie/

------------

Austerity is turning Germany into a basket case too

http://www.guardian.co.uk/

------------

German Exports Slump Most Since Jan 09

----------

German Industrial Output Falls Unexpectedly In December

-----------

Trade Figures Pose Growth Risk

=============

Tuesday, February 7, 2012

NP = Envisioning Employment: Employment Situation Jan = Full Time Workers Fully Under Pressure + Recovery-less Recovery: Unemployment Duration + On The Margin: Total Unemployment

[mEDITate-OR:

----------

-----------

-----------

-----------

----------

===========

Envisioning Employment: Employment Situation Jan

-------------

Full Time Workers Fully Under Pressure

--------------

Recovery-less Recovery: Unemployment Duration

-----------------

On The Margin: Total Unemployment

=========

----------

-----------

-----------

-----------

----------

===========

Envisioning Employment: Employment Situation Jan

-------------

Full Time Workers Fully Under Pressure

--------------

Recovery-less Recovery: Unemployment Duration

-----------------

On The Margin: Total Unemployment

=========

NP: On The Stamp: Food Stamp Participation Nov

[mEDITate-OR:

pretend that even after we cut off their UI benefits...

they will still be entitled to, and need, food stamps for their children to eat.

-----------

----------

-----------

============

On The Stamp: Food Stamp Participation Nov

http://paper-money.blogspot.com/2012/02/on-stamp-food-stamp-participation.html

========

pretend that even after we cut off their UI benefits...

they will still be entitled to, and need, food stamps for their children to eat.

-----------

----------

-----------

============

On The Stamp: Food Stamp Participation Nov

http://paper-money.blogspot.com/2012/02/on-stamp-food-stamp-participation.html

========

Subscribe to:

Comments (Atom)